ILLUMINA (ILMN)·Q4 2025 Earnings Summary

Illumina Beats on Q4 EPS, But Q1 Guidance Sparks 5% After-Hours Selloff

February 5, 2026 · by Fintool AI Agent

Illumina (ILMN) delivered a strong Q4 2025, beating consensus on both the top and bottom line, but the stock fell ~5% in after-hours trading as Q1 2026 EPS guidance disappointed. The genomics leader posted non-GAAP EPS of $1.35 vs $1.21 consensus (+11.6%) and revenue of $1.16B vs $1.10B consensus (+5.5%).

The standout metric: clinical sequencing consumables ex-China grew 20% YoY, the fourth consecutive quarter of acceleration and a sign that Illumina's core sequencing franchise is gaining momentum in healthcare applications.

Did Illumina Beat Earnings?

Yes—and by a wide margin. Q4 2025 marked Illumina's fourth consecutive earnings beat.

The EPS beat was driven by disciplined cost management—operating margin expanded 400 basis points YoY to 23.7%—and stronger-than-expected consumables revenue.

Illumina also exceeded its own preliminary guidance from January, when it indicated EPS of $1.27-$1.30. Final results came in at $1.35, suggesting execution beat internal expectations.

What Did Management Guide?

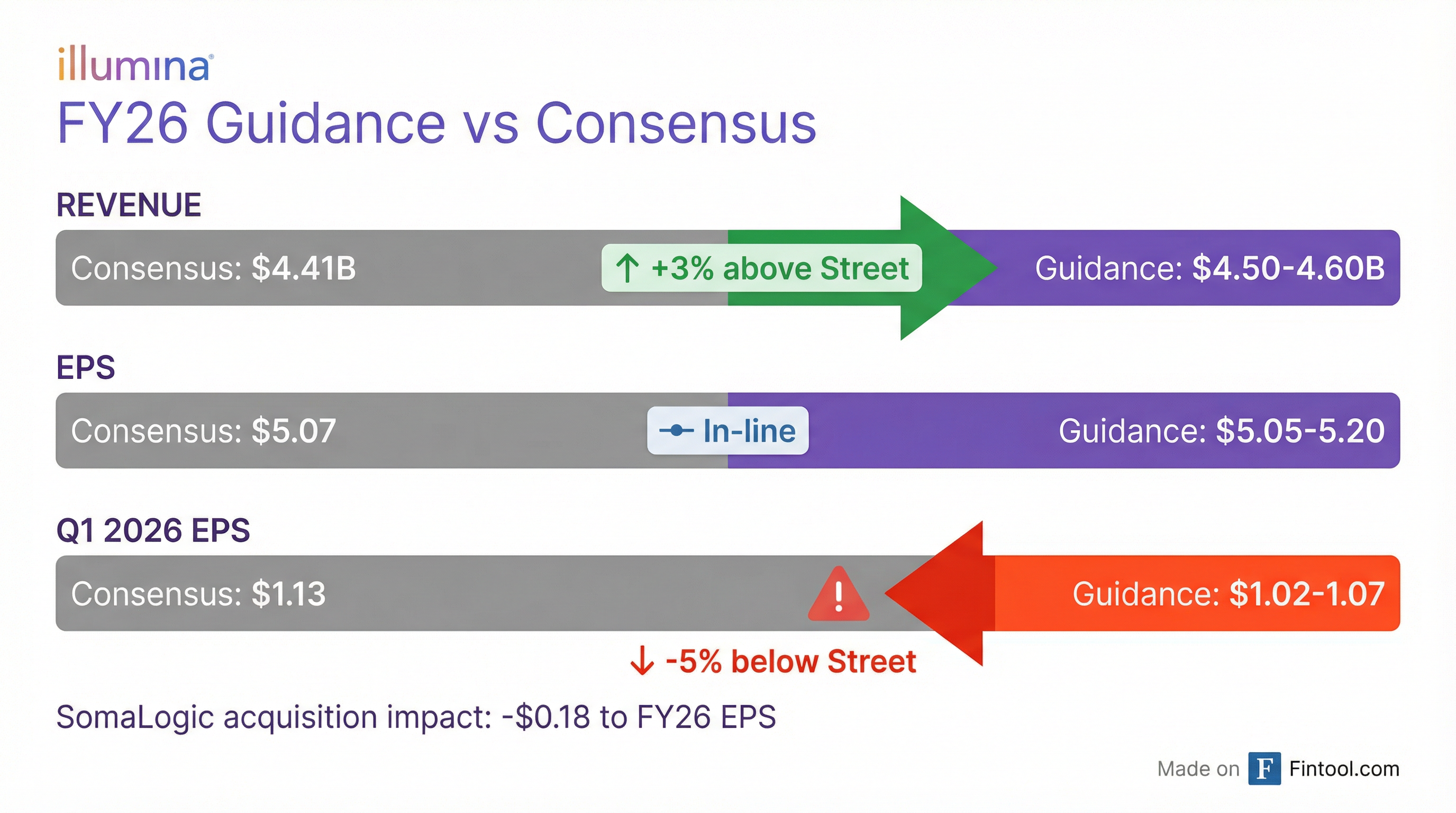

FY26 guidance came in above Street expectations at the midpoint, but Q1 2026 disappointed—and that's what moved the stock.

FY26 Outlook (Above Consensus)

*Values retrieved from S&P Global

FY26 guidance includes a 1.5-2.0% revenue benefit from the SomaLogic acquisition (closed January 2026) and $0.18 EPS dilution.

Q1 2026 Outlook (The Problem)

*Values retrieved from S&P Global

The Q1 2026 EPS guide of $1.02-$1.07 is notably below the $1.13 consensus, implying ~5% downside to Street estimates. This appears to be the primary driver of the after-hours selloff.

How Did the Stock React?

Illumina closed regular trading at $133.61 (-0.4%), but fell ~5% in after-hours to ~$127.

The selloff comes despite:

- A 12% EPS beat in Q4

- FY26 guidance above consensus

- Accelerating clinical consumables growth

Context matters: ILMN had rallied ~95% from its 52-week low of $68.70 to recent highs near $155, so some profit-taking on any disappointment isn't surprising. The stock is still up 55% from August 2025 lows.

What Changed From Last Quarter?

Clinical Momentum Accelerating

Clinical sequencing consumables ex-China grew 20% YoY in Q4, up from 12% in Q3 and 10% in Q2. This acceleration reflects growing adoption of next-generation sequencing in oncology, rare disease diagnostics, and population health screening.

NovaSeq X Transition Maturing

The transition to NovaSeq X is nearing completion:

- 80% of volumes and 55% of revenue transitioned to NovaSeq X

- Research transition nearly complete: ~90% of high-throughput research volumes now on X

- Clinical more than two-thirds converted; remaining transition tied to new WGS adoption

- Over 100 NovaSeq X placements in Q4 (second-highest quarter since launch); 890 active installed base

- Over 60% of Q4 X placements were clinical customers

Management expects the conversion to be "substantially complete by the end of 2026," with pricing headwinds from the transition continuing to dissipate, especially in H2 2026.

SomaLogic Acquisition Closed

Illumina completed its acquisition of SomaLogic on January 30, 2026, entering the proteomics market.

Key deal terms:

- $350M cash upfront, plus potential royalties and milestone payments

- Expected 1.5-2% revenue contribution in 2026

- $0.18 EPS dilution in 2026

- Expected to be margin-accretive by 2028

CEO Jacob Thaysen highlighted the strategic rationale: "Proteomics is the frontline in multi-omics, and with SomaLogic now part of Illumina, our position in this key growth market is significantly stronger."

Dr. Eric Green Joins as Chief Medical Officer

Illumina appointed Dr. Eric Green as Chief Medical Officer, bringing extensive experience from his role as Director of the National Human Genome Research Institute at the NIH. Management expects his leadership to be "a catalyst for driving continued adoption of genomics and multi-omics toward standard of care for patients."

China Headwind Persists

Greater China revenue declined 30% YoY in Q4 ($55M vs $80M), continuing the trend from earlier quarters. For FY25, China was down 21% YoY. Illumina remains on China's "unreliable entities list," which continues to pressure demand.

Key Segment Performance

Revenue by Source (Ex-China)

Revenue by Region

Cash Flow and Balance Sheet

Full-year FY25 free cash flow was $931M, up 34% from $695M in FY24 (or down from $1.07B on a Core Illumina basis pre-GRAIL spinoff).

Q&A Highlights: What Analysts Pressed On

Clinical Growth Durability

When asked about the step-down from 7% ex-China growth in Q4 to 2-4% guidance for FY26, CFO Ankur Dhingra explained: "We took the average for the second half to bracket our overall guidance. The Q3 of 2025 is what we're using as the low end... If research does improve, that certainly provides an upside."

Competitive Dynamics

On competitors' $100 genome pricing claims, CEO Thaysen was confident: "Our customers are thinking way beyond just one parameter, one feature. They are more sophisticated than just looking at one element... We feel we have the portfolio, we have the pipeline, we have the capability to compete on all parameters."

NIH Funding Outlook

Management noted recent NIH budget announcements are a "welcome development" and could provide upside to research assumptions if funding flows resume. However, uncertainty remains: "There are still a lot of uncertainties for the institutes for how grants are being distributed and who's actually getting these grants."

China Path Forward

On China's unreliable entities list, Thaysen said: "We have had great conversations and collaboration with the Chinese regulators to ensure that we can continue to run our business in China... If there's a way to get off the list or see improvements in that, I think there's upside to the China business."

BioInsight Monetization

CFO Dhingra outlined the multi-year strategy: "The monetization strategy here would be in 2 or 3 different ways. One is around very specialized data and AI tool constructions. And then over time, we see significant subscription-based models where we can help pharma companies both on the discovery as well as on the development side."

Forward Catalysts

-

SomaLogic Integration: First integrated NGS-proteomics products expected in 2026-2027; margin expansion path to Illumina-level by 2028

-

Clinical Adoption: 20% clinical consumables growth suggests sequencing is crossing the chasm into routine healthcare. CEO Thaysen: "Customers are choosing to make larger and larger panels... I think actually the intensity, meaning the larger panels, is going to be the main growth driver going forward."

-

BioInsight AI Platform: Launched with the Billion Cell Atlas—the "most comprehensive map of human biology for drug discovery." Initial pharma collaborations announced with AstraZeneca, Merck, and Eli Lilly.

-

Multi-Omics Pipeline: Spatial transcriptomic solution and Constellation map read technology both on track for H1 2026 launch. Management expects multi-omics and BioInsight to contribute 1-2% growth by 2027.

-

Onso Technology IP: Acquired from PacBio to "keep optionality" on sequencing chemistry while remaining "very bullish about our SPS technology."

Management Confidence Level

CEO Thaysen expressed high confidence in the long-term strategy: "I'm confident that our long-term strategy is working, reinforced by the progress we made in 2025 and where Illumina stands today... We remain on track toward achieving our long-term financial targets for 2027."

On the 2027 targets (high single-digit growth, 26% operating margins), management acknowledged SomaLogic dilution but committed to getting "as close to the 26% operating margin as possible in 2027."

The Bottom Line

Illumina delivered exactly what long-term bulls wanted in Q4: accelerating clinical adoption, expanding margins, and strong cash flow. The 20% growth in clinical consumables ex-China is a powerful proof point that sequencing is becoming a mainstream healthcare tool.

But the stock is reacting to Q1 guidance, not Q4 results. With Q1 EPS guidance 5% below consensus and SomaLogic dilution layered in, near-term earnings expectations need to reset. The question for investors: is this a buying opportunity into a secular growth story, or a warning sign that the FY26 setup is too optimistic?

Key positives from the call:

- Clinical growth drivers are structural (WGS adoption, MRD, early cancer detection), not cyclical

- BioInsight platform already attracting top-tier pharma partners (AstraZeneca, Merck, Eli Lilly)

- NIH budget clarity could provide upside to research assumptions

At ~26x forward EPS (based on the $5.12 midpoint of guidance), Illumina is no longer cheap by historical standards—but the clinical momentum and proteomics optionality may justify the premium.

View the Q4 2025 earnings slide deck and company profile for additional details.